Addendum: Endgame Perils of Restaking

A supplement to Endgame Perils of Restaking.

Extended TL;DR / Summary

Restaking protocols are explicitly framed as opt-in, but when we examine how out-of-protocol yield distorts the incentive structures of the Ethereum Network, we see that over time, restaking can become a macroscopically coercive force on all validators.

The subsidization of an open-set of validators allows adopters to operate in a lower base APR environment and out-compete non-adopting validators. This dynamic is not unique to restaking; it is also observed with liquid staking tokens and MEV-boost. However, the three have different risk factors and operating mechanisms. They must be discussed both separately and together.

Isolating restaking, we can consider the following thought experiment; for simplicity, we neglect the risks and MEV rewards, allowing base yield to be transformed into risk-adjusted yield.

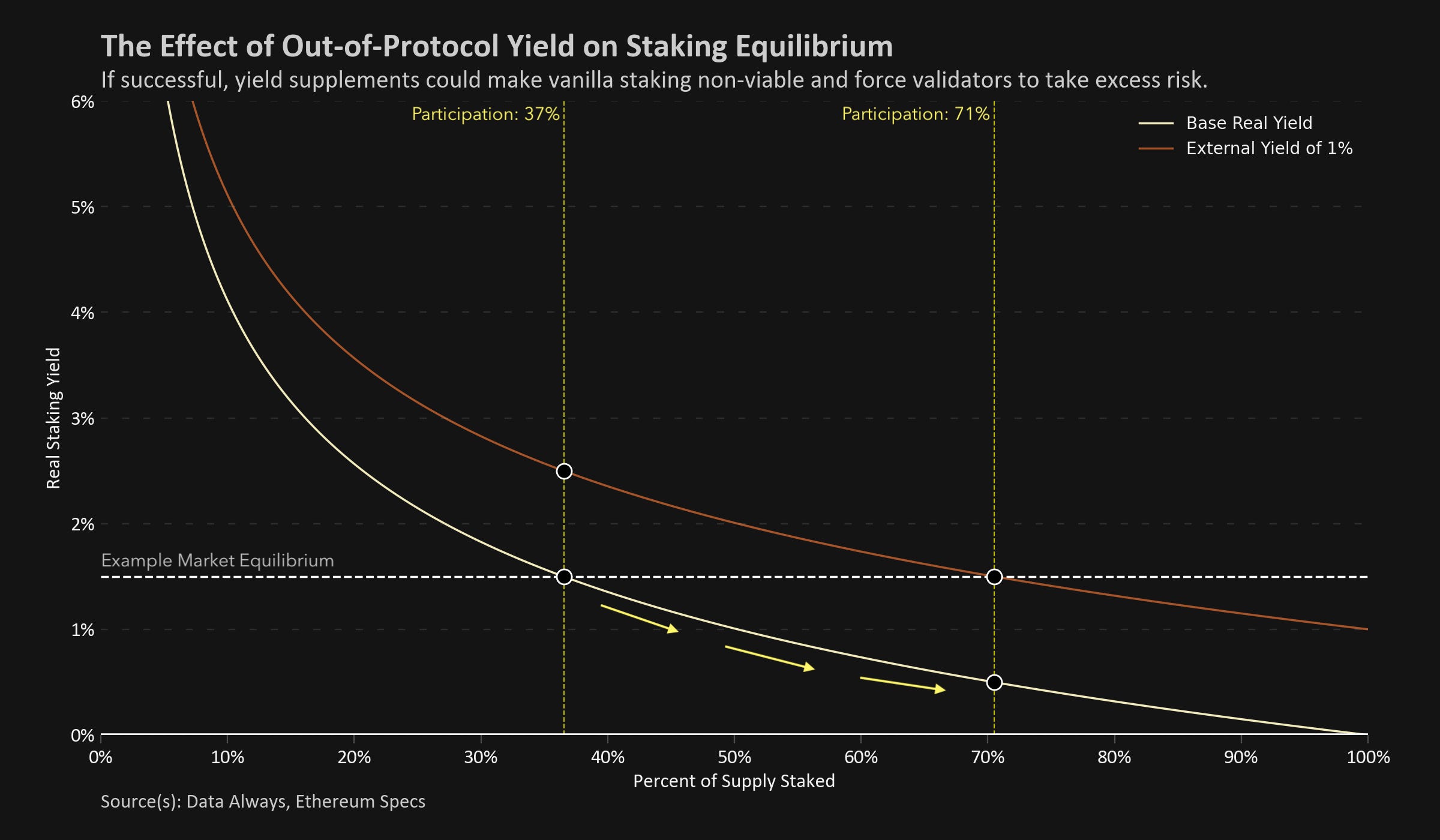

Assume that the market equilibrium demands a real staking yield of 1.5%. In an unperturbed market this occurs at approximately 37% of the current supply staked.

Assume there is an infinite supply of restaking yield at 1%. Validators who adopt restaking can now operate with a base real yield of 0.5%, pushing the equilibrium staking participation rate to 71%.

Validators who do not adopt restaking now only earn 0.5% and are priced out of the market.

Validators who adopt restaking are only better off until everyone else also adopts restaking. The Ethereum Network suffers because total issuance is higher and a larger share of the supply is staked and limited in usability1.

Proof-of-Work Corollary

Effective consensus systems inherently involve costs. In the case of Bitcoin miners, this cost manifests as the energy associated with incorrect hashes. Ethereum validators sacrifice the liquidity of their staked assets.

One optimization that is frequently discussed by Bitcoin miners is waste heat reuse. Analysis conducted by Paul Sztorc demonstrates that heat reuse is functionally equivalent to an improvement in hardware efficiency; leading to an increase in revenue, but in a competitive environment also prompting miners to increase spending and offset the added revenue. After accounting for difficulty adjustments, if everyone leverages heat reuse then the profit equilibrium is unchanged2.

Restaking protocols operate with the same principle, reusing waste illiquidity by creating shared security protocols. The endgame result is the same as waste heat reuse: the profit equilibrium for validators is unchanged in a competitive market.

Restaking vs Liquid Staking

A few people pointed out that the article was flawed because it didn’t address the similarities between restaking and liquid staking tokens. We agree completely; in fact, the mental model we’ve built is that restaking turns vanilla staked tokens into bespoke liquid tokens whose properties are defined by a smart contract. Calling them liquid is a misnomer, but giving non-liquid staked ether access to a form of DeFi through restaking layers offers many of the same benefits and will impact the overall ecosystem.

Liquid staking tokens have similar endgame effects (when used for non-looped yield), but their associated risks are more frequently and openly discussed by the community. In fact, the risks shared by liquid staking tokens and restaking are additive, which implies that we should expect to see compounding impairment of Ethereum’s monetary tools as supplemental yield on tokens designed to be illiquid continues to grow.

The conversation is bigger than restaking, but the normalization of restaking by influencers makes it a pressing topic to address.

Solutions

Many people view monetary policy around validators as a yield up or yield down mechanic, with the preferred tool for disincentivize staking participation being to lower base yield3 -- and more recently the idea of burning MEV rewards.

Although both these ideas are attractive from a tokenomics standpoint, if the community chooses to decrease the yield paid to all validators, the effect is to shift down the yield curve making out-of-protocol yield far more important. Our thesis is that lowering base yield or burning MEV will push more validators towards liquid staking options and restaking protocols. Game theory suggests that as in-protocol yield drops near 0%, the entire market will be captured by offerings that supplement validator yield.

A complete solution must disincentivize out-of-protocol yield while incentivizing vanilla staking. The best idea we’ve heard is Justin Drake’s suggestion of airdrops to solo validators—i.e., the community could choose to cut base yield in half and then redistribute the other half to validators that that are not using CEXs, liquid staking options, smart contracts, etc.

Although we believe that Drake’s suggestion is intriguing and directionally correct, we also feel that it violates the credible neutrality of the protocol, and likely should be disqualified. It could be implemented by a third-party with a vested interest in the decentralization of the network, but enshrining it in the protocol or having it governed by an organization like the Ethereum Foundation would be cause for concern.

Such a solution would also lead to the gamification of validation setups, which if possible, should be avoided4.

The solution discussed in the original article, placing a cap on the active validator set, is also imperfect.

The mechanism choice becomes incredibly important. If a standard auction is implemented it may have the same effect as reducing validator yield, with validators who adopt supplement yield protocols outbidding solo validators.

The reality is that this is a really hard problem to solve, and it’s likely that any solution will come with a trade-off. These articles are only a small piece of the puzzle, we must also consider how any changes would affect token velocity, stake centralization, MEV, tokenomic sustainability, etc.

Luckily, it is a distant problem with plenty of time for research and quorum.

Restaking acts as a form of game mining. By inserting itself into the dynamic between the Ethereum Network and validators, it warps the outcome of the game and extracts value for itself.

Although the profit equilibrium is unchanged, the network does see an increase in hash rate. This is generally good, but there’s a lot of nuance involved.

This idea is called minimum viable issuance.

This might also have positive externalities. It could push validators off of shared setups like AWS, etc.