The Year in Blockspace Demand (2022)

What blockchains did people use in 2022? And what did they use them for?

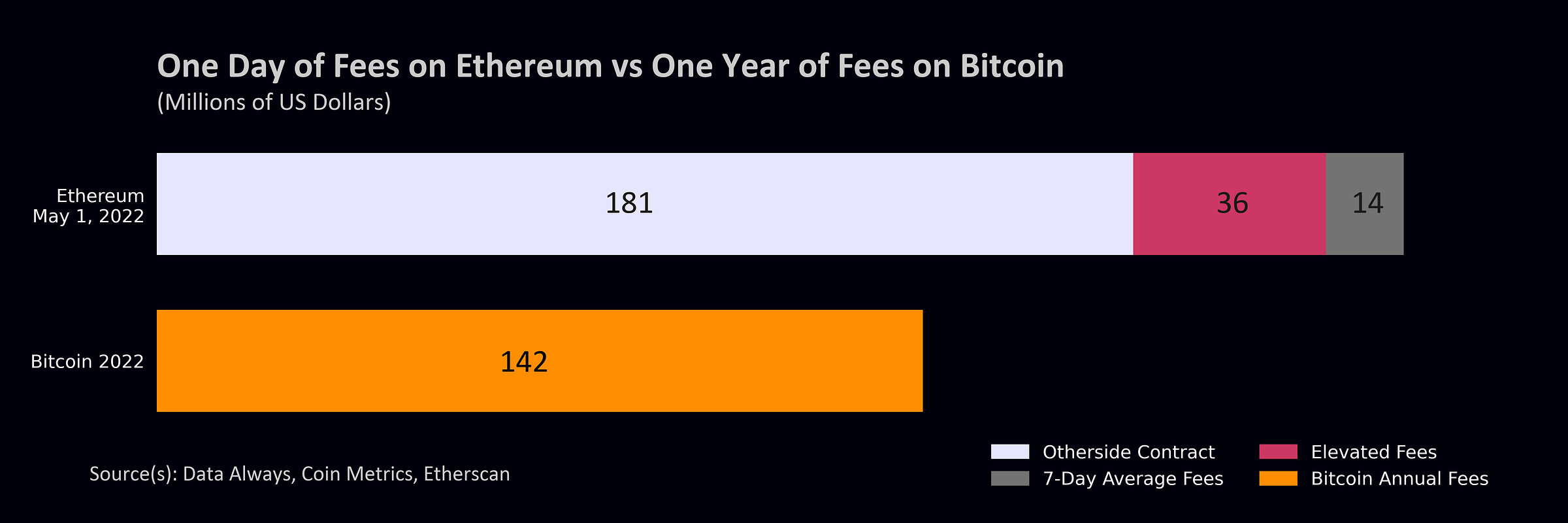

The Otherdeed NFT mint generated more fees on Ethereum in a single day than the entire Bitcoin Network did in 2022.

To most, it seems ill-conceived to burn hundreds of millions of dollars in fees for the opportunity to purchase virtual plots of land inside a future Bored Apes metaverse, but events like this are clear signals from the market about what the community wants. One of many implicit ripple effects is that the Bitcoin community’s dismissal of applications built on-top of the protocol has become a waypoint for historians: if the security model of the cryptoasset fails, a key monument in the ruins will be the decision to sacrifice the lion’s share of transaction fees in the digital economy.

Taking stock of the entire digital ecosystem, transaction fees exhibit a Pareto power law distribution with Ethereum capturing 80% of all fees. The dominance of smart contract chains is even more evident with Binance Smart Chain accounting for 80% of the remaining fees, while the largest simple transfer models (Bitcoin, Dogecoin, and Litecoin) only account for negligible fees in comparison. Without meaningful worldwide adoption of digital currencies, demand remains focused on blockchain infrastructure and digital asset applications1.

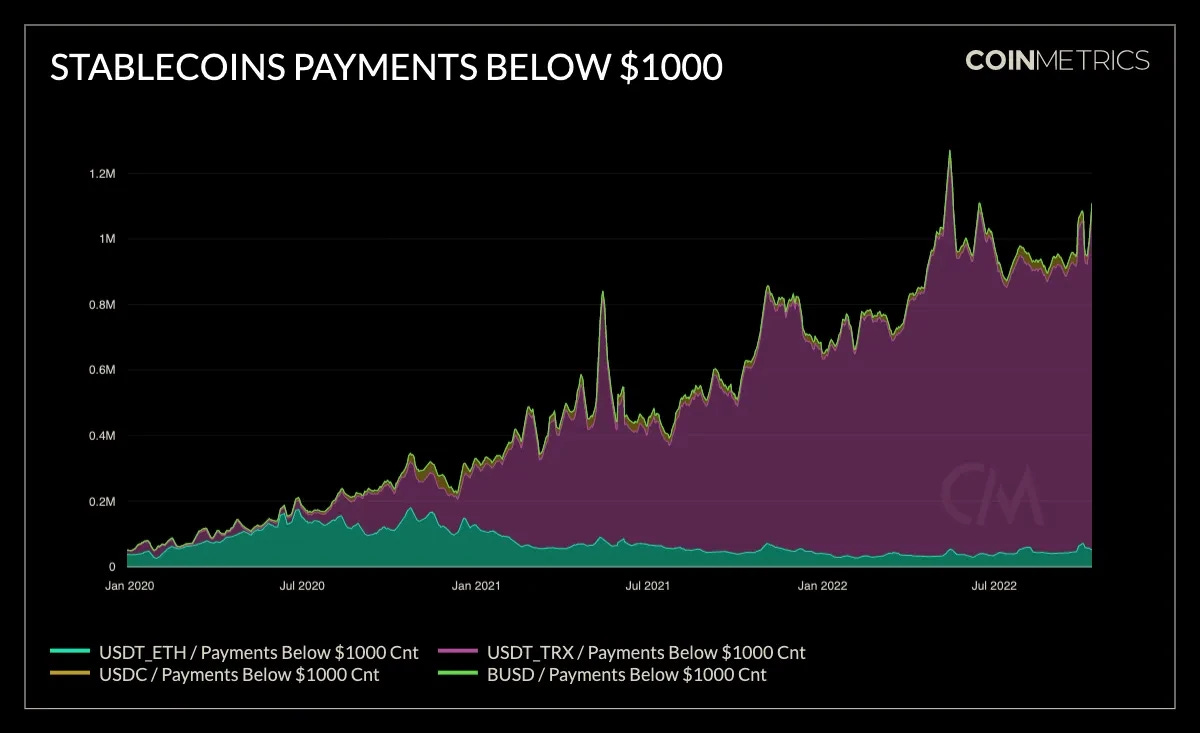

The biggest surprise of the year was Tron, which, although using a subsidized transaction model, surpassed Bitcoin for the third spot on the blockspace demand podium. A dynamic worth mentioning is the lack of correlation between Tron’s fee revenue in 2022 and that of other large chains. While Ethereum, Binance, and Bitcoin fees all fell significantly, Tron fees held relatively steady throughout the year.

One of the biggest drivers of fees, and perhaps the most important element of the Tron ecosystem, has been Tron’s capture of low-value USDT transfers. Ethereum has at times price out users, particularly in the developing world, from making payments, and Tron has stepped in as a safe haven for these users. Spurred by its USDT transfer dominance, Tron was the best performing major cryptoasset of 2022.

Well played, Justin Sun.

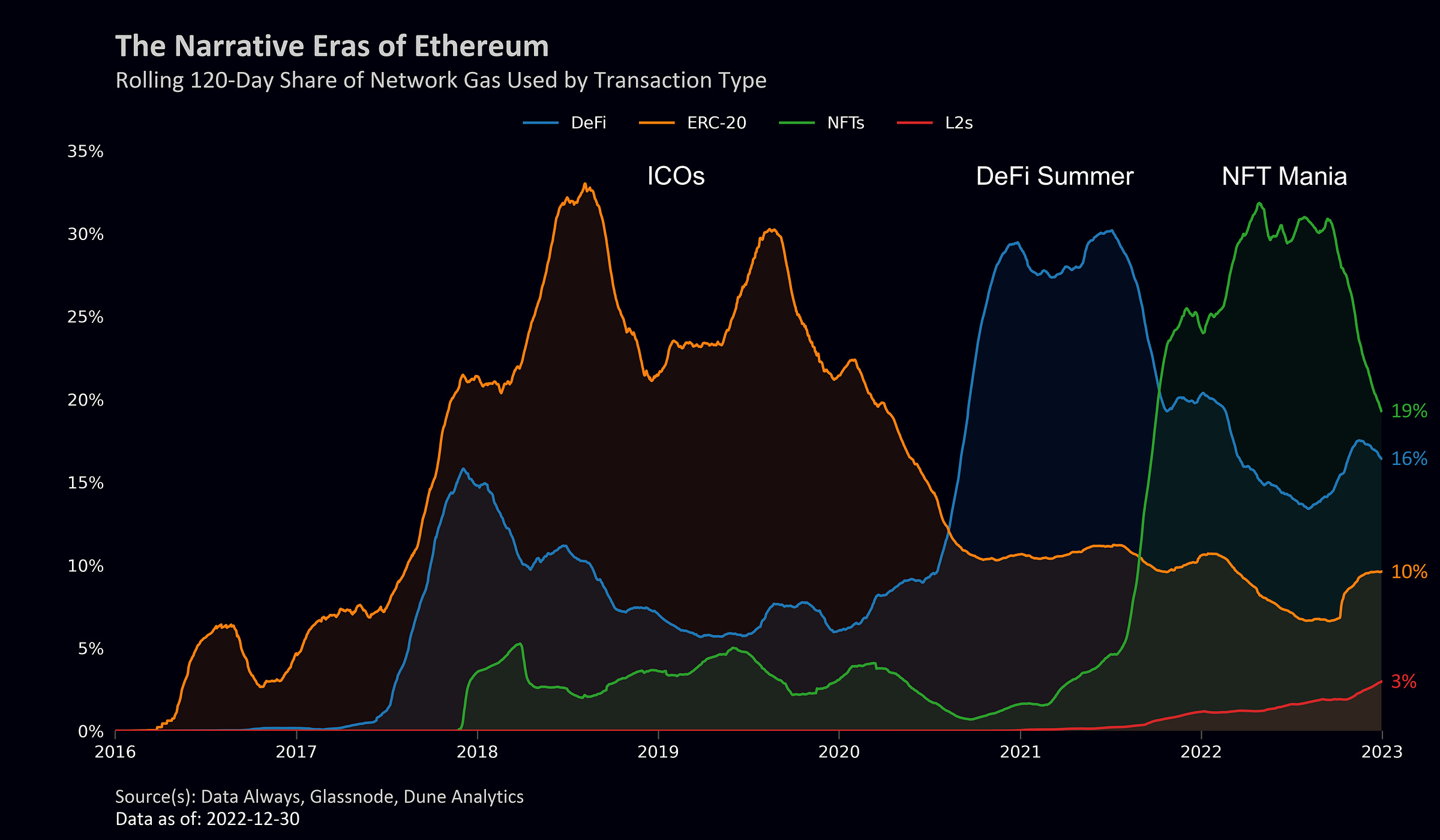

Ethereum influencers had predicted that 2022 would be the year when layer-2 protocols would begin to see meaningful usage. Despite some growth, particularly in Q4, I think it’s fair to say that adoption was underwhelming—influencers are already pivoting from L222 to L223. At the end of the day, the responsibility for the failed adoption falls on the community, but there were also meaningful hurdles to growth:

Exchanges took far longer than expected to enable L2 on-boarding.

L1 fees fell significantly which deprioritized L2 usage.

The transition to proof-of-stake took precedence over the implementation of protodanksharding.

Expectations aside, 2022 was a good year for layer-2 protocols. In an ecosystem where demand for gas among most applications plummeted, the share of gas used by L2s tripled. Bankless has a more detailed year-in-review dedicated to L2s, but the standouts for me were:

Arbitrum based GMX became a meaningful player and began generation a large amount of fees—GMX fees surpassed Bitcoin fees in Q4.

Optimism launched Quests powered by Galxe which has become the largest fee source for the protocol.

UniSwap launched on Optimism in July 2022 and OpenSea added support for Optimism in September 2022.

Bitcoiners should look at Ethereum L2s with optimism; the past two years have seen a significant decline in demand for vanilla ether transactions on mainnet, with relative L2 gas usage growing from practically nothing to 60% of the current demand for plain ether transfers. In time, if the Lightning Network can gain significant traction and develop decentralized applications that the community can rally behind, it will go a long way towards rectifying the decline in Bitcoin blockspace demand.

This base load of demand may also solve issues around cyclical transaction fees, which have the potential to introduce instability as block rewards continue to decrease. However, the Lightning Network has yet to see meaningful growth, despite influencers misleading their followers into thinking it has.

There has recently been speculation that Bitcoin transaction fees might be turning a corner and could be set to increase, but the majority of spikes in 2022 can be attributed to the collapse of crypto institutions rather than consistent transactions and the creation of a circular digital economy within Bitcoin. In my opinion, it is premature to suggest that fees will continue to be elevated or increase further.

The biggest driver of blockspace demand for Ethereum in 2022 continued to be NFTs. Starting in mid-2021, NFT related transactions reached a long-term average of one-third of blockspace usage, but have since fallen to under 20%.

Ethereum is left without a primary narrative, begging the question of what could be next. A common suggestion is that 2023 will finally see fun blockchain-based games, but until we see it happen, I remain skeptical. EIP-4844 is expected late in the year, which will make L2s more gas efficient, but elasticity is likely less than parity, suggesting that L2s may end up using less gas even as adoption increases.

My hopes are focused on a second wave of NFTs that prioritize authentication and utility rather than art. The adoption of NFT avatars by Reddit is perhaps the most promising sign that we could see widespread utilization.

Without question, the biggest event of the year was The Merge. Hiding in Bitcoin’s shadow for over half a decade, the heaviness of Ethereum’s mining issuance went significantly under discussed. As the ETH/BTC tradiing pair rocketed starting 2020, the dollar-denominated total subsidy (issuance, not fees) paid to Ethereum miners surpassed the earnings of Bitcoin miners, despite the difference in market capitalizations and the relative non-competitiveness of Ethereum mining. After adjusting for market cap, the drag imposed on Ethereum was triple that currently seen by Bitcoin. The effects of the change in tokenomics remain to be seen, but with issuance schedules more strongly affecting price reflexivity, if the bull market resumes the trading pair will be key to watch.

Bitcoin and Ethereum are on the cusp of the largest-ever divergence in desired fee dynamics. Despite a continuous chorus from Ultra Sound Money fanboys, deflationary ether is a byproduct, not the goal of recent changes to Ethereum’s monetary policy. To succeed as an asset, Ethereum must continue scaling and prioritize the usability of the protocol, even if users become relegated to L2s. Fees will always remain a KPI, but scaling faster than adoption is the new target, and it will be key to driving prices higher and cementing the role of Ethereum in the digital ecosystem.

By contrast, it is now time for the Bitcoin security model to prove itself. Fear mongering aside, fees must begin trending up—particularly price-inelastic base load, which in time will be responsible for maintaining a minimum viable level of security, as well as promoting stability, as block rewards continue to fade. If base load fails, the 21M dream may be in danger, and calls for the community to adopt tail emission will continue to increase.

As it stands, UTXOs will not be enough, and it is nearing time for the community to acknowledge that change is necessary—but possibly just in attitude.

Categorized using Coin Metrics Datonomy classification system.