Ethereum validator withdrawals

Supply surge dynamics from partial withdrawals and validator exits

February 2023 Update:

The original piece was written during the height of the Celsius recursive stETH trade and paints a more bearish picture than I think is now justified (six-months later). With the rise of liquid staking derivatives I suspect that the withdrawals unlock exodus event will be more mild than the following analysis suggests.

The process has also moderately changed. The most recent consensus specs are available here. A FAQ thread based on the process is available here.

Detailed modern analysis is available here:

TL;DR:

The choice not to phase in partial withdrawals creates a theoretical tail risk, but with the majority of staked ether locked up on exchanges and in liquid staking the short-term risk is low. It may be advisable to begin with a lower limit on the maximum partial withdrawals per epoch, but the market should be able to handle the supply surge with the current value.

Estimated reading time: 14 minutes

When I published my Ethereum Flows Model the figure below was included. At the time it was a naive and simplistic approximation, but now as the transition to proof-of-stake approaches and the technical specifications for withdrawals have been drafted, it is time to dive into the details and refine the projection.

Two separate types of withdrawal unlocks are now firmly targeted for the hard fork following the merge: partial and full withdrawals. This writing will discuss how each type will contribute to supply dynamics and whether the spike is likely and manageable for the market.

Partial Withdrawals

Partial withdrawals, often referred to as skimming, allow active validators to withdraw their cumulative staking rewards and reduce the balance of their validator down to 32 ether. This is an important feature for two reasons:

The mechanism prevents validators from having to exit (shut down) and then reactivate their validator if they want to withdraw the income that they’ve generated. This prevents queue clogging, can reduce gas fees and the work associated with running a validator, and prevents potential destabilization of the network by minimizing the rollover of active validators.

Validators have what’s called an effective balance that maxes out at 32 ether. When the balance of your validator climbs above 32 ether, there is no gain of efficiency from the excess tokens. The earned rewards are therefore unproductive and are best redeployed either into new validators or elsewhere in the ecosystem to avoid missing out on compounding rewards.

As per the Consensus Specifications, the maximum number of partial withdrawals per epoch is currently set to 256. With the number of validators at withdrawal unlocks likely being in the range of 700,000 to 900,000 (modelled later in the full withdrawals section) and each day comprising 225 epochs, all active validators should have the opportunity to withdraw their excess balance at least every 12 to 16 days. This frequency is logical once the staking ecosystem has stabilized, but in the short-term has the potential to put strain on the market.

Partial withdrawals are designed to allow a continuous trickle of tokens back into the hands of validators, but the first pass will release two years worth of staking rewards rather than the normal two weeks. Looking at all active validators, the average balance is currently 33.5 ETH, and when balancing new validator activations against accelerated rewards after the PoW switch-off the average balance should be in the realm of 34 ETH. This suggests that the Ethereum market could face average sell pressure of:

(34-32) × (225) × (256) = 115,200 ETH / day for up to 16 days.

The current distribution of validators is about 32% split between Coinbase, Kraken, and Binance, as well as a further 24% through liquid staking providers (Lido accounting for the vast majority). The 56% of validators represented by these two groups of pooled funds should be highly incentivized to partial withdraw their excess funds, but rather than sell into the market are likely to use the funds to create new validators1.

With the tokens of most long-term holders who intend to stake already locked into the staking contract, and the recent surge in liquid staking, it seems likely that the combined holdings of these two groups will rise to or above 65% of all staked ether by the time of withdrawal unlocks.

Napkin math: assuming 10% of the partial withdrawals from those groups end up selling into the market and 50% of the remaining validators follow suit, this would result in average daily sell pressure of:

(34-32) × (225) × (256) × [(0.65 × 0.10) + (0.35 × 0.50)] = 28,000 ETH / day

As a point of comparison, current proof-of-work rewards flowing into the ecosystem are approximately 14,000 ETH / day, or about 100,000 ETH / week. The market should not struggle to handle the sell pressure with this reduced selling approximation.

Full Withdrawals

Full withdrawal, also known as an exit, is a term for shutting down your validator and reclaiming your entire staked balance. The key aspect to understanding supply dynamics stemming from exits is that the number of validators that can either exit or become active is rate limited.

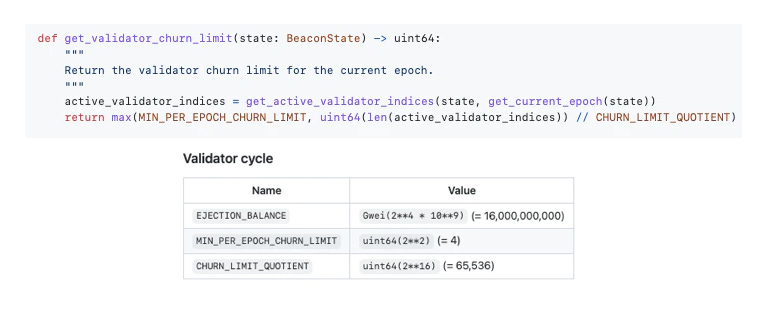

The rate limiting is described by a churn limit that is in place to ensure both the stability and the security of the network. It is specified in the following two code snippets:

The churn limit is the larger of the number 4 and the rounded down quotient of the number of active validators against 65,536. If the number of validators is less than 327,680 (65,536 × 5), every epoch (32 blocks @ 12 seconds per block) only 4 validators each can be activated or exit the active state and withdraw their staked ether (once withdrawals are active). Once the number rises above 327,680 that number begins to increase.

This milestone was first surpassed March 31, 2022 and the churn limit currently sits at 5.

Stepping into the beacon chain deposits data, there has been a resurgence in staking demand as continued progress has been made on the transition to proof-of-stake. Monthly rolling ether denominated deposits are at their highest value since the initial surge when the beacon chain went live in late-2020, and denominated in US dollars deposits are at their highest ever value (over $130 million per day). This has mainly been driven by a surge in liquid staking, particularly Lido.

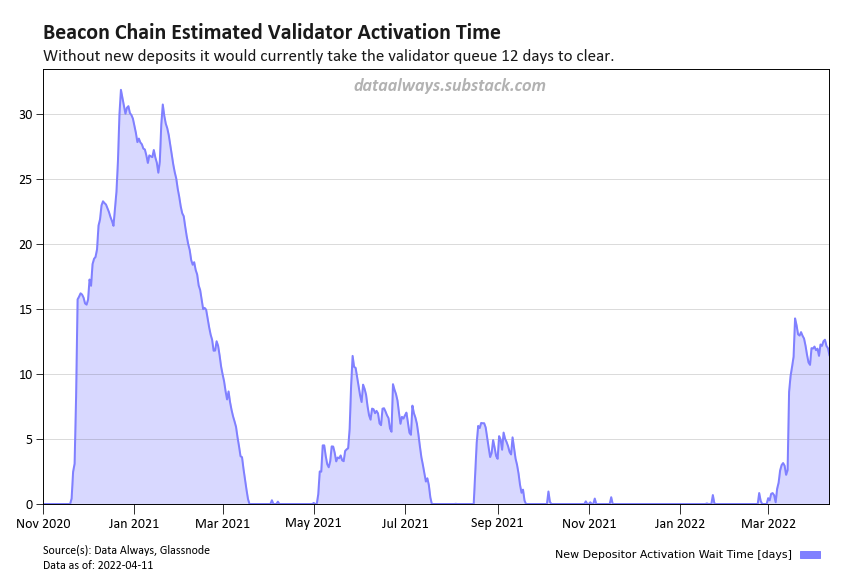

As the number of deposits exceeds the churn limit, a queue forms inducing a waiting period for new deposits to begin collecting staking rewards. This wait time, seen in the figure below, is another driver for the surge in liquid staking demand, because not only are your tokens not locked until after withdrawals are enabled, but also because you gain immediate exposure to staking yield.

The rise of liquid staking and the significant progress made on the transition to proof-of-stake have significantly reduced an individual’s risks involved with staking. This has led to the surge in validator deposits since late-February and has congested the activation queue. Assuming further technical progress on the transition and then a successful merge, it seems unlikely that the recent pace of deposits will slow significantly—if anything it may continue to accelerate. As such it makes sense to model the evolving churn limit and to place an upper bound on active validators.

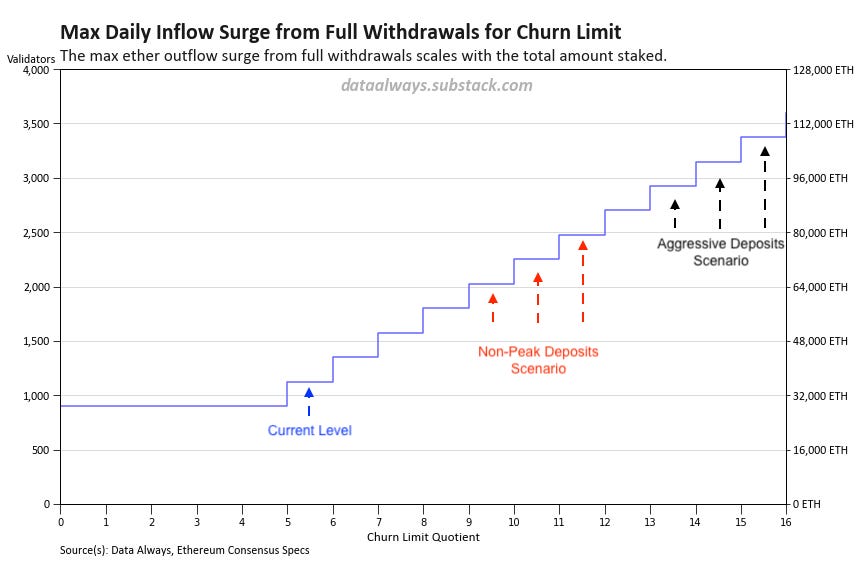

Switching back to withdrawals, the maximum short-term surge of validators and ether able to exit can be estimated through the expected future churn limit.

Decoding the figure below, one can extract that in a less aggressive deposit scenario where the churn limit at unlock is 9 to 11 the exiting validators have the potential to represent 64,800 to 79,200 ether per day. In a more aggressive deposit scenario exiting validators could represent 86,400 to 108,000 ether per day.

An important consideration is that exiting validators will on average only choose to sell a fraction of their tokens. The figure below represents a theoretical maximum inflow surge, but as an example, if exiting validators were to on average sell only 50% of their tokens, the inflow surge seen by the market would be cut in half.

The timeline for any fraction of validators that want to exit active state remains relatively constant because the churn limit scales directly with the number of active validators—there are inefficiencies from integer division at lower churn limits, but as the churn limit increases the relative inefficiencies tend to zero.

Speculating about the fraction of validators looking to rapidly exit when withdrawals are enabled is a difficult exercise. Some of the factors to consider are:

Older validators that have had their tokens locked for longer may be more likely than average to want to exit, but they also would tend to have deeper belief in the Ethereum protocol and thus be less likely than average to want to exit.

If the deposit queue is large and the activation wait time is significant, validators will be less likely to want to exit because it is harder to once again become a validator.

Liquid staked ether holders would appear to be the group most likely to want to exit, but holders of rETH, stETH, etc. have the ability to exit their positions before withdrawals are enabled.

With surge rates and settling times modelled, projections can now be built to examine the impact from a surge of validator exits. With the additional de-risking of staking after withdrawals are unlocked, the likely outcome is queue clogging for both activations and exits which will hold the churn limit steady until all exit demand has been accommodated by the network.

In a peaceful transition model where market conditions are calm and validators are incentivized not to exit by a large activation queue, the sell pressure from full withdrawals is a non-event that passes quickly.

In an aggressive exit model where market conditions are more volatile and there is significant profit taking, the surge in sell pressure from full withdrawals remains manageable, but has the potential to be longer lasting than the surge from partial withdrawals.

As always, the most likely scenario is something between the two.

Combined Withdrawals Supply Response

Combining the two withdrawal types to form a best-case and a worst-case supply surge, one can see that a peaceful exit model with only moderate sell pressure from partial withdrawals is a mostly non-event that lasts one-to-two weeks. A more contentious and panicked unlock event with large profit taking could however be a market destabilizing and relatively long-lasting event.

At the end of the day, I remain bullish as ever. Withdrawal unlocks are simply an event to get through on the path to a generational investment opportunity. With additional demand from the cryptocurrency community and traditional financial world after both a successful merge and when withdrawals are enabled, assuming a smooth transition the market should be able to handle the surges. A phased-in per epoch limit on partial withdrawals would help me sleep better, but may be unnecessary.

-T.

I think we’ll likely see sell pressure from exchange staking withdrawals, but that it is more likely these will take the form of full withdrawals not partial withdrawals, although from a practicality standpoint there is significant obfuscation when dealing with exchanges and it’s unclear what redemption methodology they will choose.