The state of bitcoin transaction fees

(Part 1) How are miners handling the bear market and how is miner revenue from transaction fees comparing to expectations derived from past cycles?

Author’s Note:

This article discusses the current state of Bitcoin’s security spend and the progress that has been made in the transition from a subsidized revenue model to a self-sustaining system paid for via transaction fees. The goal of part one is to ensure that the reader has data available to them, not to argue whether the current state of (or trend in) transaction fees sets bitcoin up to be over or under secured.

Part two of the discussion asks questions about the long-term dynamic and the endgame of bitcoin’s proof-of-work design.

tldr;

Industrial bitcoin mining margins have heavily compressed; collapsing their equity valuations (~90% decline) and causing public miners to liquidate portions of their treasury holdings to ride out the bear market.

Revenue from transaction fees now accounts for a smaller percent of total mining rewards than the previous halving cycle (despite the subsidy being cut in half). The ratio of transaction fees to network value has defied expectations and currently is at its lowest point since early 2011.

The Current State of the Mining Market

The large profits enjoyed by bitcoin miners are gone. The Chinese mining ban in May 2021 set the stage for a period of mining excess and of hash rate expansion that, with the recent market downturn, has left the mining market oversaturated.

Despite what many might think, this isn’t necessarily a bad thing. Bitcoin miners do not magically deserve a printing press and it is essential to keep the mining market competitive and to keep profits low—lest industrial miners become a class of citizen above everyone else.

The reason why diminished profits are important is the restructuring that they induce. In this case, pressure is put on the margins of miners who are primarily profit focused allowing for miners that create positive externalities to outlast those with negative externalities.

Miners who survive the bear market will generally have these characteristics:

Industrial miners:

Extremely cheap energy contracts

New and more efficient mining machines

Good access to capital markets or good treasury management

Grid balancing applications

Flare mining applications

Retail miners:

Dual purposed for home heating

Focused on non-KYC bitcoin (privacy premium)

Abundant and cheap (often renewable) energy

For many of the same reasons, Zack Voell argues that retail miners are more resilient and more adaptable than industrial miners. I tend to agree, but I also don’t expect their long-term relative share of hash rate to increase. When an industrial mining farm goes bankrupt and liquidates their machines, the likely outcome is for their collection to be bought up by other miners not sold piece by piece to hundreds or thousands of home miners.

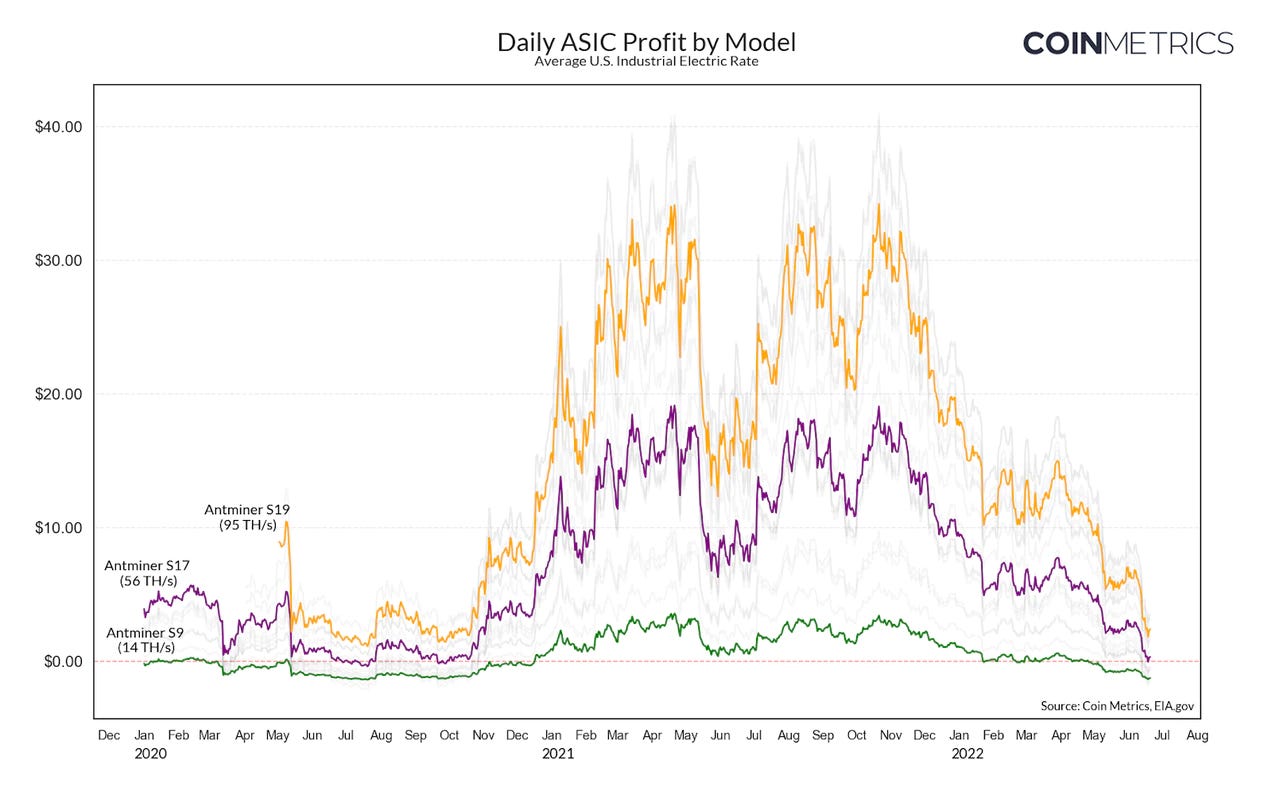

Coin Metrics takes the data a step further and calculates the profitability of running older vs. newer mining hardware, assuming average industrial electricity rates, to find that Antminer S9s, a preferred choice amongst home miners, are already non-profitable. Only the newest generation of miners, which are 170% more efficient (in TH/W), remain profitable although their margins have shrunk by close to 90%.

With the decrease in mining profitability, publicly traded industrial bitcoin miners have been seen their valuations cut significantly. Four of the biggest miners: Marathon Digital, Hut 8, Riot Blockchain, and Core Scientific, have seen average stock price decreases of over 89% since early November. With the price of bitcoin falling 69% in the same period, the average valuation of these miners has fallen over 65% denominated in bitcoin.

Bitcoin miners are often viewed as leveraged bitcoin exposure, and as such with the correlation between miners and spot price currently at 0.90, executives at these companies have an outsized interest in dismissing concerns about the cryptoasset and bringing a quick end to the bear market to relieve the pressure on their margins.

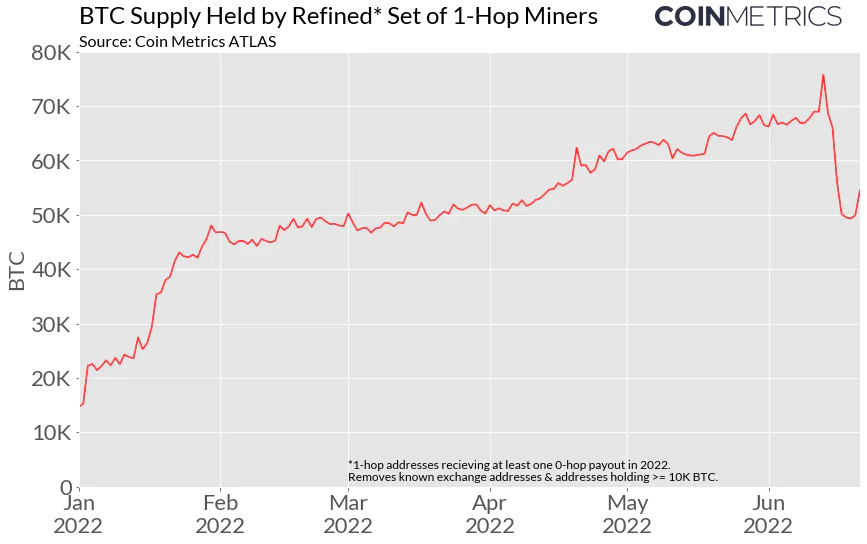

With intense pressure on mining margins and many industrial miners committed to increasing their hash rate over the next 12 months, public and private miners have begun dumping bitcoin to ensure operational capability throughout the bear market. The capitulation is observable on-chain, with data publicized again by Coin Metrics in a recent State of the Network.

These large sales should serve as a reminder that although the incentive structure for industrial miners frequently aligns with regular holders, publicly traded companies are businesses first and at times the relative incentives will diverge.

The selling extends a level further than bitcoin, for example the founder of Core Scientific Darin Feinstein recently sold $18 million of his equity (1, 2)—his remaining shares are now worth approximately $55 million1.

Executives selling equity is obviously fine, but when a company’s valuation has fallen 90% in seven months, these sales are another signpost to encourage a cautionary approach. They also represent a stark contrast from the image Feinstein projects on Twitter suggesting that the long-term dynamics around bitcoin mining’s profitability are healthy and that concerns are unwarranted.

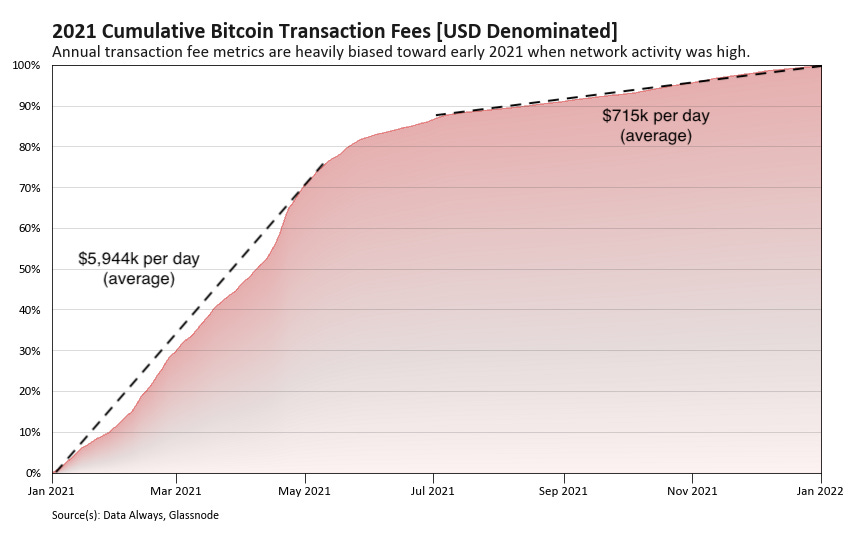

What Feinstein leaves out in the tweet above is that the majority of those transaction fees were accumulated in early 2021 before blockspace demand quickly died off. After averaging close to $6,000,000 per day in miner revenue from transaction fees in the first four months of 2021, the second half of the year saw this number drop 88% to just $715,000 per day.

Transaction fee revenue has weakened even further in the first half of 2022. Despite fee surges due to heightened price volatility, transaction fees are averaging only $463,000 per day—pacing for $169 million for the full year (a cumulative total that in 2021 was surpassed on February 10). This dollar denominated revenue would be the second lowest since 2016 during which bitcoin traded in a range of $354 to $979.

Long-Term Trend in Transaction Fees

Arbitrary annual data points aren’t a pragmatic measurement of the evolution of miner revenue dynamics. To paint a credible picture we need to look at cyclic trends and how historic models have performed.

A good starting point is to examine the evolution between four year reward cycles (frequently referred to as halvings).

Based on the four year subsidy cycle, with the block reward cut in half we should expect a sizeable increase (although less than a doubling2) in the share of revenue from transaction fees should fees—a proxy for blockspace demand which correlates highly with usage metrics—remain constant. The initial drop in fee percent (blue circle) indicated a less frothy maximum demand between bubble bursts (arguably good), but the cycle over cycle decline in fee percent paints a more concerning picture.

By definition, the above metric must go to 100% in time. Bitcoin’s security model is such that a high initial subsidy allows the network to bootstrap new miners until its network usage and fee revenue grows sufficient to pay for those miners—if that fee revenue is declining cycle-over-cycle it suggests that the transition may not be smooth without drastic changes.

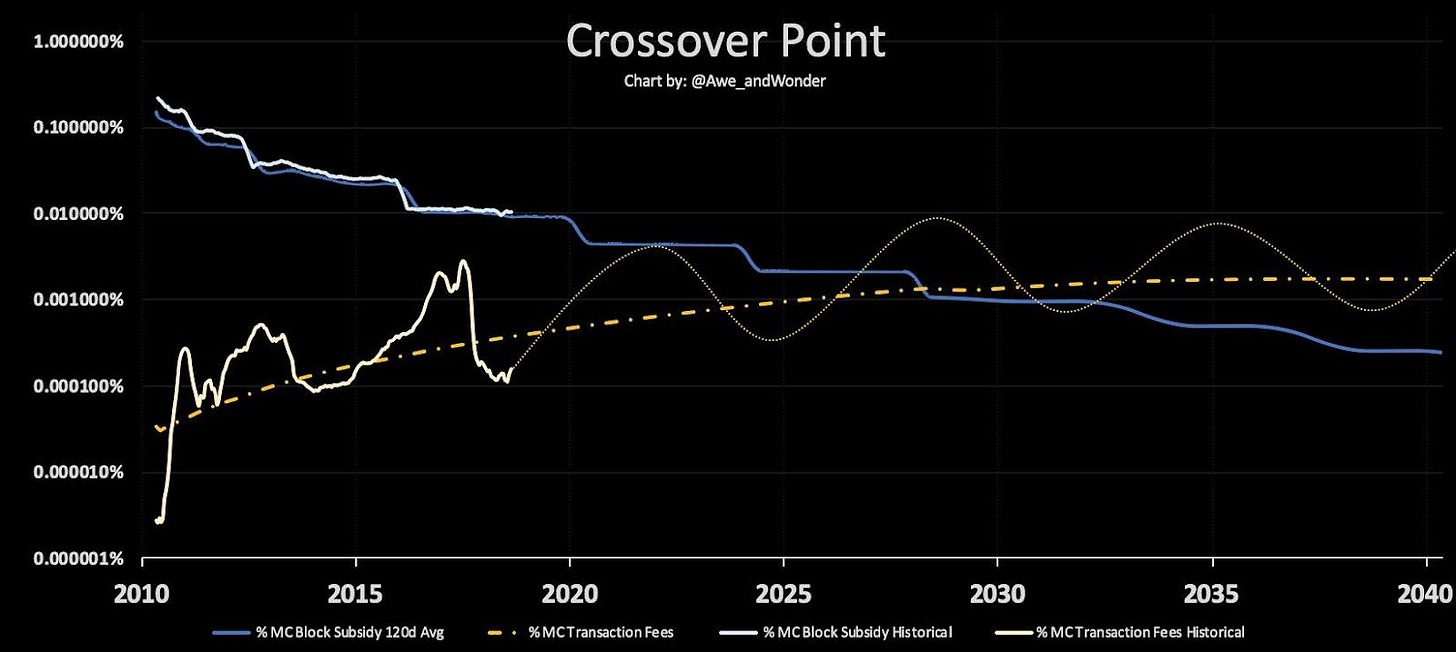

Diving deeper into the statistics, we can look at modeling done by @Awe_andWonder3 that was heavily covered in Dan Held’s 2019 article Bitcoin’s Security is Fine. Serving as one of the main rebuttals of the era to concerns over low fee revenue during the 2018-2020 bear market, the standout figure was an examination of periodic but upwards trend in transaction fees against the backdrop in declining block subsidy.

The model suggested that at this cycle’s peak the share of fee revenue would nearly equalize with the block subsidy and that by some point around the 2028 halving, the majority of miner revenue would permanently transition to transaction fees.

Recreating the model using the same 120 day moving average as Awe_andWonder, this cycle the share of fee revenue peaked at 12.0% in May 2021—below the 2018 peak of 16.7% and well below the predicted path.

Further, with the recreation we can observe that despite the predicted uptrend in fee security, the ratio of transaction fee revenue to market cap has now fallen to its lowest point since early-2011, when there was only an average of 1,000-2,000 daily active addresses (compared to 900,000+ today).

Decoding that statement: transaction fees are scaling slower than bitcoin’s network value; on the current path, the terminal security spend of the network has the potential to settle at a lower collateralization ratio then the current state of fee-only revenue: 0.027% per year or about $1 per year in revenue to secure every $3,700 in network value.

If sufficient, a security spend ratio of this magnitude would make bitcoin an extremely efficient store-of-value, but it does beg the question: are the fees sufficient?

Value as of market close June 27, 2022.

Holding fee revenue constant between cycles, four year rolling fees of 4.51% on June 29, 2018 would have translated to 8.27% on June 29, 2022.

After posting his modelling, @Awe_andWonder has since disappeared from Twitter.

Thank you for the post T!