Explained as simply as possible:

Inscriptions (frequently referred to as Ordinals) are modern NFTs on Bitcoin. The biggest advantage inscriptions hold over Ethereum NFTs is that their data is stored directly on the blockchain, unlike Ethereum NFTs, which usually store hashes or links to data hosted elsewhere. This makes inscriptions heavily resistant to censorship, but also inherently more expensive and antagonistic to other transactions (by using more blockspace).

Because inscriptions lack ecosystem support, and Bitcoin is not designed to leverage smart contracts, the utility of inscriptions beyond protest messages is lacking in the short-term and will fall far short of Ethereum NFTs for the foreseeable future.

The community is divided, but those who take a stance against inscriptions have limited avenues to resist and are currently relying on social signalling.

In-depth descriptions are available here: Coin Metrics, pourteaux.

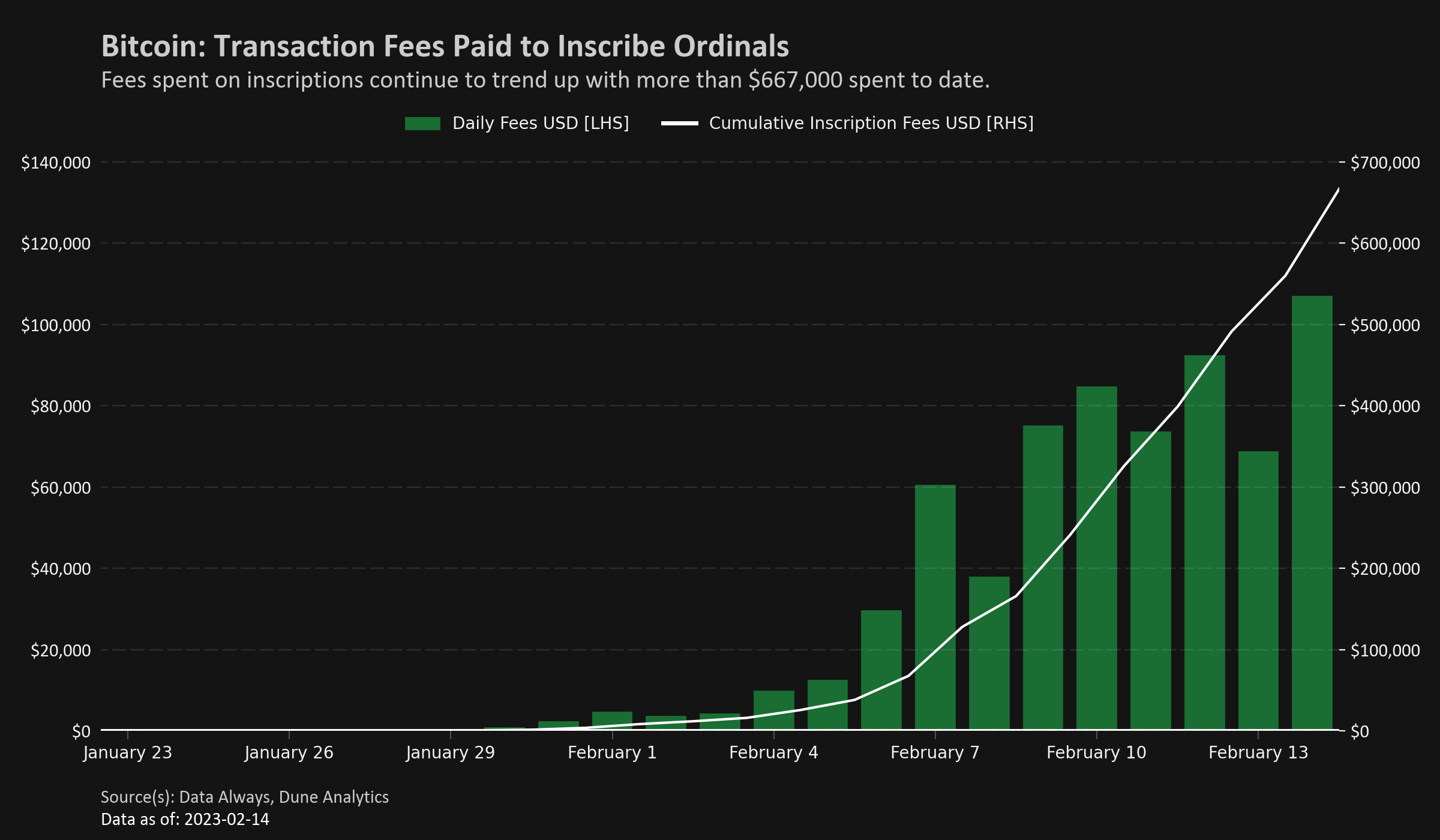

Inscriptions are currently experiencing a gold rush, with tens of thousands of people darting into the space in an attempt to get in early. While fee growth has showed some signs of tapering over the past few days, the week-over-week metrics remain explosive. It's uncertain whether spending will accelerate again, but by examining the data more closely, we can be amongst the first to explore the clues left behind by the market.

Bitcoin blockspace is notoriously cheap, with simple transfers accounting for the vast majority of transactions, and fees having been stagnant since the summer of 2021. Over the past year, transactions have represented less than 2% of rewards paid out to miners, which is an unsustainable level for a cryptoasset seeking to transition from a subsidy to a transaction fee model.

To distinguish between bloat transactions and fees that contribute to meaningful network security, I often use a fee rate threshold of 25 sat/vB. If the average transaction fee were at this rate, transaction fees would represent approximately 4% of mining rewards, which is still far too low for long-term sustainability, but provides a starting point to build from.

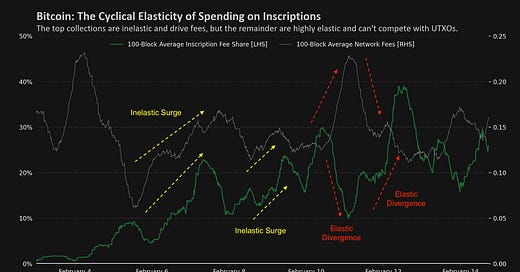

In the figure below, low fee rate transactions have been filtered out to separate inscriptions that provide meaningful fee support to miners from those that are primarily taking advantage of cheap blockspace. The analysis reveals that few high-value periods have occurred, with less than 4,000 inscriptions taking place at a fee rate over 25 sat/vB.

The two categories of inscriptions exhibit distinct behavior in response to changes in network demand. The high value transactions, which include an initial surge on February 6th and 7th and the inscription of Bitcoin Punks in the following days, were highly inelastic, consume a significant amount of blockspace, and drive fees up for the whole network. In contrast, the low fee-rate transactions have been highly elastic and take advantage of periods of low demand for blockspace. These low-value transactions provide a base load of activity to support miners and have helped to minimize the frequency of empty blocks.

Some have suggested that blockspace has become more competitive, but using intrablock transaction velocity as a proxy for temporal competition, analysis reveals no significant change.

During periods of heavy demand, we should expect a divergence from uniform transaction density. This occurs because later transactions gain asymmetric information about the mempool and are able to outbid earlier transactions, resulting in an uneven distribution of transactions within a block. But to date, inscriptions have not generated a detectable divergence.

If competition for early inclusion does rise, we should observe a shift in density towards the profile of the slow blocks sample.

Although we have not observed a significant increase in intrablock competition, we have seen a moderate uptrend in fee spend. While fees are still well below recent surges, the rise of inscriptions is the first positive fee catalyst in two years, and should be celebrated. Whether or not inscriptions are a sustainable source of fees for the network remains to be seen. However, they are certainly more sustainable than the cascading collapse of centralized institutions.

Although still a positive development, when contextualized on a longer timescale, the recent uptick in fees is barely noticeable. Anyone championing inscriptions as a long-term solution to concerns around Bitcoin's security model is likely getting ahead of themselves.

A true long-term solution to Bitcoin's security model will be characterized by rising base load, which is an area where inscriptions have shown exceptional performance.

Despite the low average and median transaction fee levels, the mempool backlog of low sat/vB transactions has drastically reduced the frequency of near-empty blocks. As a result, the least valuable quantiles of blocks have seen a sustained surge in rewards.

While the potential for inscriptions to support Bitcoin's security model is real, execution is far from certain and the current level of fees is meaningless.

Both proponents and detractors are currently relying on misleading communal talking points. Inscriptions are both over-hyped in a community that has had nothing positive to rally behind in over a year, and casually dismissed by a near-religious sect of the Bitcoin community that has lost sight of reality.

Development of a thriving ecosystem will take years, and discussions around the value proposition of inscriptions are far too early and data scarce.

To date, the growth in inscriptions has not priced out ordinary transactions, and despite their outsized use of blockspace, their negative externalities are mostly theoretical. It will be crucial to continue gathering data.

Thanks for this awesome analysis and write-up