Is it insane to speculate on Friend.Tech keys?

At least for big accounts, the answer is yes.

Note: this article was originally published as early access for my friend.tech chat. It has been opened to the public by popular demand.

TLDR;

The fees taken by friend.tech are too high to facilitate healthy speculation on large accounts, and should be changed to scale dynamically with key numbers.

In order for a purchaser to break even on a Racer key today ($15,500), over $700,000 of net key purchases must follow before they can exit.

Note: this writing assumes basic knowledge of what friend.tech is.

Key prices on friend.tech are determined by a quadratic bonding curve, with the price per key, in ether, scaling with the number of keys as follows:

Key numbers are not cleanly displayed in app, but we can take the inverse of the bonding equation to backsolve for the number of keys outstanding based on the current price.

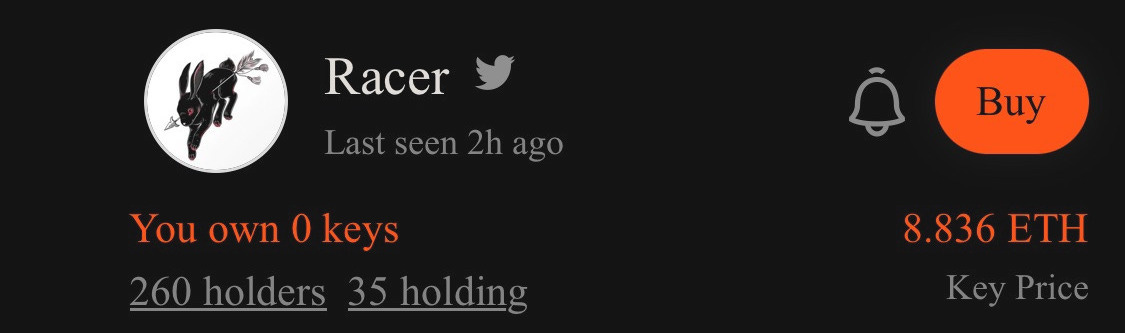

Using Racer, the creator of friend.tech, as an example, his key price is currently 8.836 ETH indicating that there are 376 keys in circulation (260 unique holders, and 116 held in duplicate). Any of those 376 keys could be sold right now for about $12,600 (after fees).

From a speculation standpoint, the consensus (amongst our circle) seems to be that buying keys from more expensive accounts is the way to trade successfully. However, the math shows that the difficulty is underestimated.

Although the bonding curve results in quadratically increasing price, with every price increase being greater than the last, the relative price changes decrease with 1/N.

This equation demonstrates that to change the price of a key by a given percentage requires more and more purchases as the number of keys in circulation grows. This should intuitively make sense: if there are 1000 existing keys any purchase should have a smaller effect than if there are only 10 keys.

However, when we pair that equation with fixed-percentage transaction fees, breaking even while speculating on large accounts becomes very challenging.

To calculate the requirement precisely we look at the following inequality where delta is the number of new buyers after the purchase of key N:

Solving the inequality results in:

In practice for a speculator to break even for a given key price requires the following number of net-purchases after they acquired their key:

So, although you could buy a Racer key today for 8.836 ether, watch 10 new entrants buy after you and believe that you have paper gains of 0.476 ether, in reality the purchase actually costs you 9.720 ether and the sale only nets you 8.381 ether, for a realized net loss of 1.339 ether ($2,150).

The amount of money that needs to flow into Racer keys after a new purchase today for you to be able to sell at a profit is pretty incredible.

Before fees, this ether inflow is valued at over $640,000. Accounting for 10% transaction fees on all those purchases, the cost grows to over $700,000.

Paper gains are everywhere and the fees on keys are way too high to allow for a graceful exit. Speculation probably makes more sense in the 40-80 key range where the return on capital doesn’t require a half-million dollars of ponzinomic capital to flow in after you.

Speculate at your own risk.