A brief recap: what was the London hard fork?

The London hard fork was a group of changes implemented to the Ethereum protocol on August 5th, 2021. Two of the changes stand out as the most important: Ethereum Improvement Proposal 3554 (EIP-3554) and EIP-1559.

EIP-3554 was a proposal to delay the difficulty bomb that will swap ether mining from proof-of-work to proof-of-stake to December 2021. This was done because the development community wanted more time to test and verify that the transition will go smoothly. This transition will be huge for the network, but it’s important that the changes aren’t rushed, so the delay was expected and is healthy.

EIP-1559 was a redesign of the fee system. Many people misunderstood the purpose of the upgrade as having the goal of reducing the fees associated with transactions, but the goal was actually to improve fee clarity and to stop blind bidding for transaction room. A side-effect of the change is that block rewards for miners are now constant and any excess gas spent on transactions is burned by the network—creating deflationary pressure on the circulating supply. The supply is still inflationary, but the decrease in rate has been larger than most expected, as will be seen in the following figures.

Digging into the data.

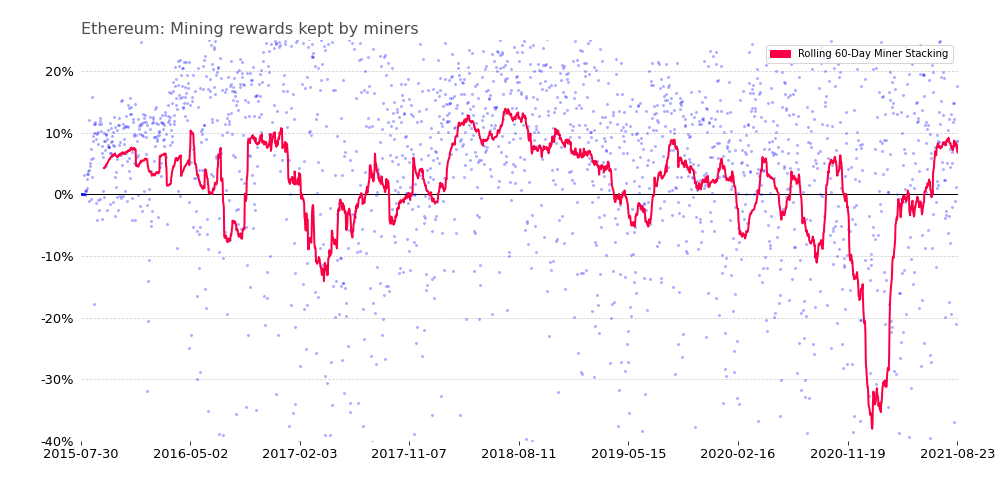

I think I could probably just attach this chart without commentary and call that the entire post. As can be seen, the mining rewards have been relatively constant since the fork dispelling one of the biggest worries from before the change. It is true that with the recent heavy network use the fees would have traditionally been higher for the miners than they have been, but the block reward is set high enough that miner profits haven’t been eaten into too badly. Certainly nothing to cause a revolt.

At the same time, the fee burn is exceeding even most of the optimistic estimates. There was a lot of talk about a decrease in sell pressure between 10-30%, which the market has yet to see and that I believe was short-term misunderstood, but the decrease in net-issuance and market supply has been quite dramatic. So far the average burn rate has been about 35% over the three weeks post-change. The variance is also a welcome sight because it shows that the changes are working exactly as designed—burning more tokens during heavy congestion periods, ie: the more the network is used, the more valuable each token becomes. For an application heavy network this is a dream come true, it does however pose minor long term concerns should the changes become deflationary (rather than disflationary) before scaling reaches an adequate level because your tokens could become too valuable to be worth using.

As for the inflation rate of the token supply, the decrease has manifested. The supply is still moderately inflationary, so the long term concerns above and not yet a matter worth worrying over. With the change, the inflation rate is now relatively inline with the inflation rate of bitcoin (1.93%), however the path to reach that point has been very different—remember that ethereum had a 70% pre-mine / ICO compared to no pre-mine with the Bitcoin network. I expect the inflation rate of the ethereum supply to remain in the 1.5% to 2.5% range until the transition to proof-of-stake hopefully in the next year and the implementation of sharding later in 2022 (which will hopefully push the supply moderately deflationary).

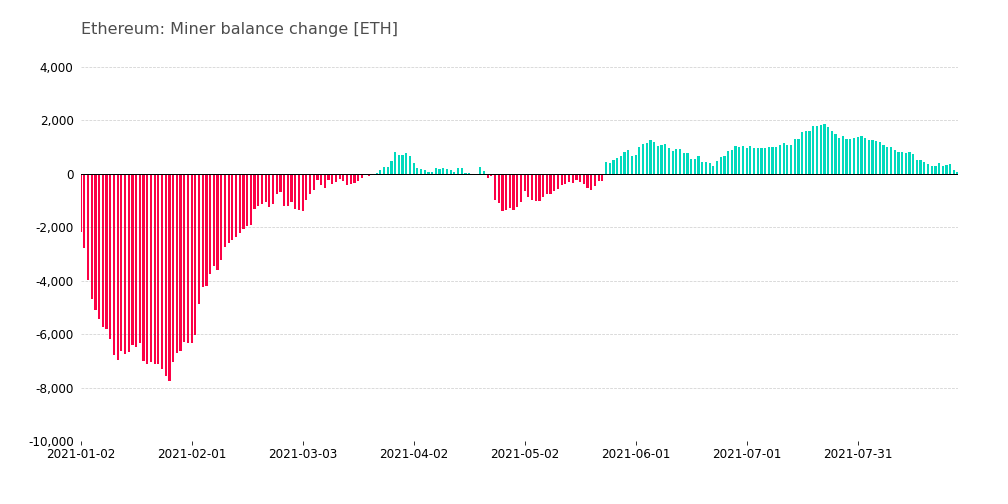

Looking at all-time miner balances it can be seen that the recent price run-up has been structurally very different than the run that started late in 2020. The late-2020 to early-2021 run saw the largest sustained miner selling that the market has ever seen. Not only did miners net keep no fees, but they were sellers of an excess of approximately 400,000 ether (market value ~ 1.3b$) over this period. After the recent drop there has been some accumulation by miners, but it has again begun falling and the market is now seeing stabilization in miner balances.

As a quick note, it may look in the prior chart as if miners at times are extremely heavy accumulators of tokens, however as can be seen in the figure above, even during the heaviest of accumulation periods miners still sell approximately 90% of their rewards. It is a good reminder that miners are running businesses and are not necessarily long term investors using mining as a way to accumulate tokens.

Looking at the miner balances on a 30-day rolling average for the year, the market is starting to see that stabilization in miner balances. Miners are still slowly accumulating, but since the fork the number has decreased a meaningful amount. This means that although miners have recently stacked some ether, the stacking has largely stopped, so if one thinks of miner balances as a spring waiting to unload during heavy bull markets to cash out (having the side effect of tempering price rises), this spring is no longer being coiled up. Miner balances remain at a healthy level that the market should be able to absorb over time.

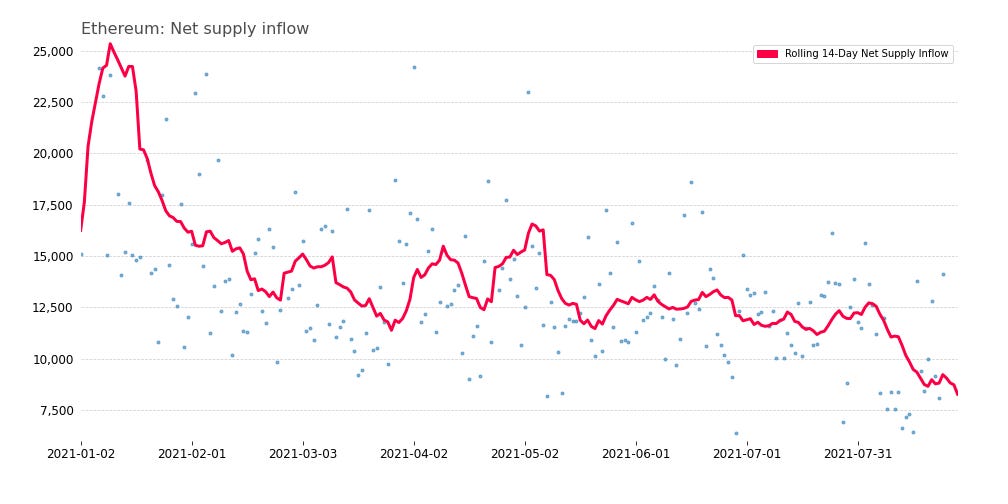

Defining the net supply inflow as the change of supply of coins outside of the hands of miners, it can be seen that EIP-1559 has put the market in uncharted territory. Never before has there been a sustained increase this small of new coins into the market. And it appears that this is the new normal.

Zooming in, it can be seen that new coins coming into the market has fallen below 10k per day. When prices were similar in early-May the number was closer to 15k per day, so the market flux is about 5,000 eth (market value ~ 15M$) lower per day.

Contrasting the lower supply inflow, examining daily miner sell pressure it can be seen that although sell pressure is far below the peak seen in early 2021, there has not been a meaningful decline in sell pressure since the fork. Balancing this with the change in supply inflow, this is an indication that supply of coins is really starting to dry up (technically increase at a slower rate). This is exciting and extremely bullish.

When taking into account the number of coins locked in the ETH 2.0 and other smart contracts, as well as the early stages of institutional demand for bitcoin, and to a lesser extent ethereum, investments it’s clear that the market is setting up for a large supply squeeze. The questions are when? And what will be the catalyst?