Cryptocurrency Portfolio Optimization

How to best allocate for all market conditions in a cryptocurrency only portfolio?

Authors Note:

This post looks exclusively at cryptocurrency price data and makes no judgements or recommendations about the fundamentals behind any of the discussed projects. I have no idea which will or won’t be successful.

Any implied bias is unintentional.

Table of Contents:

Risk Curves

Optimal Altcoin Allocation During Bull Markets

Optimal Bitcoin / Ethereum Split During Bull Markets

Optimal Bitcoin / Ethereum Split for Long Term Holding

Optimal Bear Market Cryptocurrency Allocation

Risk Curves

If you’ve ever listened to Raoul Pal, founder of Global Macro Investor and Real Vision, you’ve undoubtedly heard him talk about risk curves and using them to shape your portfolio. But what is a risk curve and how do you determine how to efficiently allocate your funds across various cryptocurrencies without going overboard?

In 50 words, a risk curve:

Assets with higher potential upside tend to be more volatile. We want to balance the increased possible returns against the increased volatility—if we can make the same money with a less volatile portfolio it makes sense to optimize our holdings to do so.

Optimal Altcoin Allocation During Bull Markets

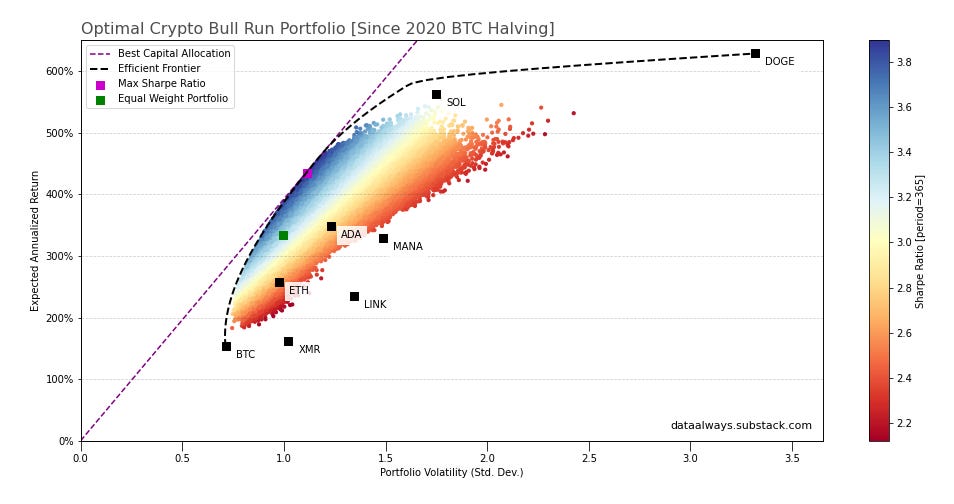

Cherrypicking the timeframe to match up with the 2020 Bitcoin Reward Halving, it can be seen in the figure below that, despite the favourable temporal choice, Bitcoin has underperformed most major altcoins—but after adjusting for the additional volatility the lower returns seem more justifiable. With less risk comes smaller returns.

In my eyes, these cryptoassets separate into two distinct classes: good and poor capital allocations. For each annualized return there is a high volatility and a low volatility option to choose between.